|

THE GUARDIAN 21 OCTOBER 2022 - POUND FALLS AND UK BORROWING COSTS RISE DESPITE JEREMY HUNT DEBT PROMISE

Chancellor says he will do ‘whatever is necessary’ to bring down national debt.

The pound fell and government borrowing costs rose on Friday despite a promise from

Jeremy Hunt that he would do “whatever necessary” to bring down national debt.

With financial markets weighing the potential for a continued instability inside the

Conservative party after the election of a new leader, the chancellor said getting the public finances on a stable footing was essential.

Government borrowing reached £20bn in September, £2.2bn more than last September, and £3bn more than economists expected, sending debt interest payments to a record high.

Higher borrowing pushed debt interest payments to £7.7bn last month, according to the Office for National Statistics, £2.5bn more than in September 2021 and the highest September figure since monthly records began in April 1997.

Hunt said: “Strong public finances are the foundation of a strong economy. To stabilise markets, I’ve been clear that protecting our public finances means difficult decisions lie ahead.

“We will do whatever is necessary to [get] drive down debt in the medium term and to ensure that taxpayers’ money is well spent, putting the public finances on a sustainable path as we grow the

economy [sustainably, one would hope].”

Market fears over a number of tax-cutting measures announced by the former chancellor

Kwasi Kwarteng in his mini-budget – and swiftly undone by Hunt – ultimately resulted in the resignation of

Liz Truss as prime minister

[for 44 days] on Thursday, and underlined the scale of the challenge facing her successor.

Government borrowing costs edged higher on Friday, with the interest rate on 10-year and 30-year government bonds climbing above 4%. The pound was down a cent against the dollar, at $1.1121, before recovering some ground to be down 0.3% at $1.1205.

Analysts at ING, who had previously said 10-year UK government bonds would struggle to stay below 4%, warned Hunt that a budget “delivered a matter of days into a new prime minister’s tenure, with a set of measures that have been crafted without their input” could further spook markets.

“There’s a chance that the plan gets pushed back a week or two – albeit at the expense of occurring after the Bank of England’s meeting on 3 November,” they said.

The Institute for Fiscal Studies said the steep rise in government borrowing during the summer meant the total for the financial year could reach £200bn, more than double a forecast made by the Office for Budget Responsibility (OBR) in March.

Officials at the OBR, which provides the Treasury with independent forecasts for tax revenues and economic growth, estimated the government’s borrowing would hit £99.1bn in the year to the end of March 2023.

The then chancellor, Rishi Sunak, warned the deficit could rise as the impact of the war in Ukraine was felt in rising energy bills, wiping out the government’s scope to fuel growth with higher spending.

Carl Emmerson, an IFS deputy director, said the budget planned for 31 October should be delayed until the political situation had settled down, leaving the chancellor to reconfigure the public finances to take account of inflation and rising debt payments.

He said the most recent figures gave “little guide to how much borrowing will be over the whole of this financial year, as the huge cost of government support for household and business energy use only began in earnest this month.

“We need a credible plan to ensure that government debt can be expected to fall over the medium-term. Given the timeline for determining the next prime minister, the degree of economic uncertainty, and the importance of getting this right, there is a strong case for taking a bit longer to make good decisions which have more chance of standing the test of time rather than going ahead with a major fiscal event only a few days into the new PM’s tenure.”

James Smith, a research director at the Resolution Foundation, said higher borrowing added £5bn to the bill compared with the OBR’s March forecast, which was “a reminder that amid the current political turmoil, the tough task facing the government of demonstrating its fiscal credibility lies immediately ahead rather than behind”.

The government’s total debt

pile, excluding public sector banks, climbed to £2.45tn, or about 98% of gross domestic product (GDP). Compared with September 2021, this was an increase of £213bn or 2.5 percentage points of GDP.

Figures from Eurostat, the EU’s statistics agency, showed the average debt to GDP ratio across its 27 member states declined to 94.2% in the second quarter of the year from the previous three months.

The ratio of debt to GDP rose in France to 113.1%, and 108.3% in Belgium, while Germany’s remained stable at

67.8% [well done Germany].

Italy’s debt pile decreased almost 2% to 150.2% on the previous quarter and from 164% before the coronavirus pandemic. Ireland, Greece and Cyprus were among other countries to cut their debts as a percentage of GDP.

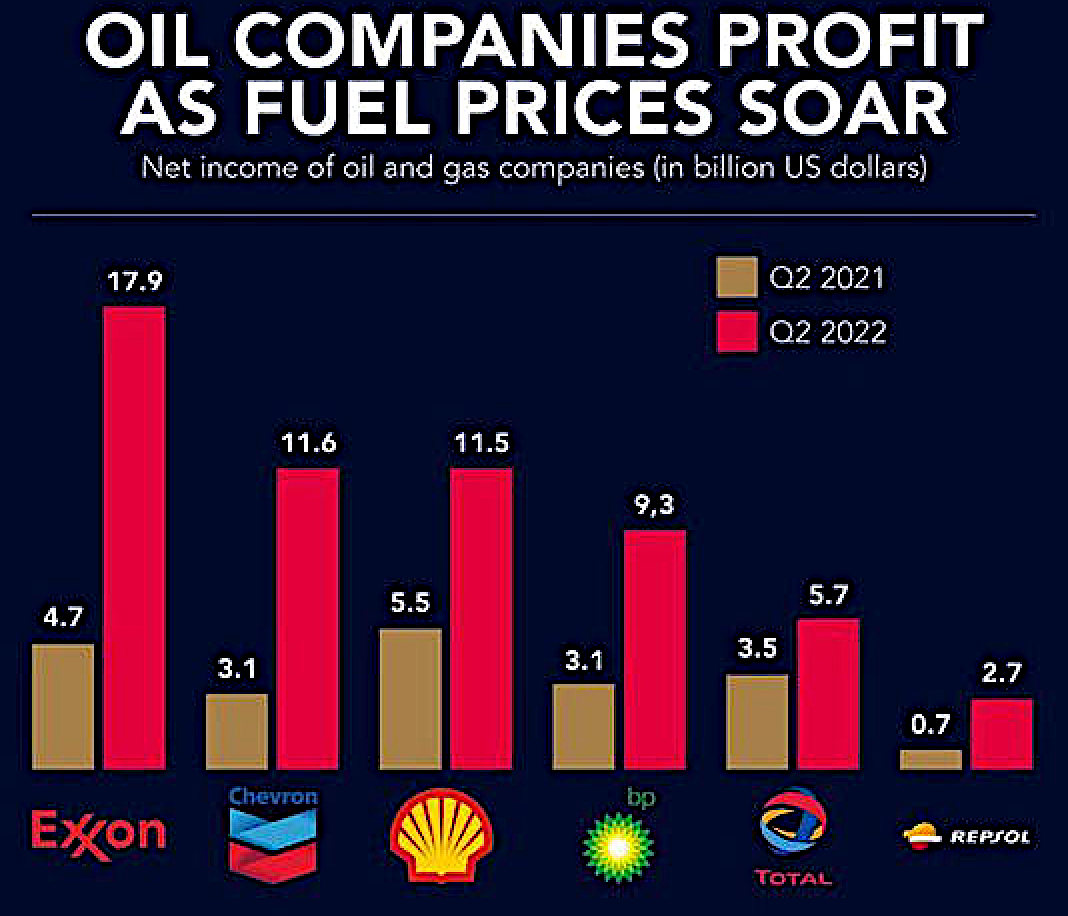

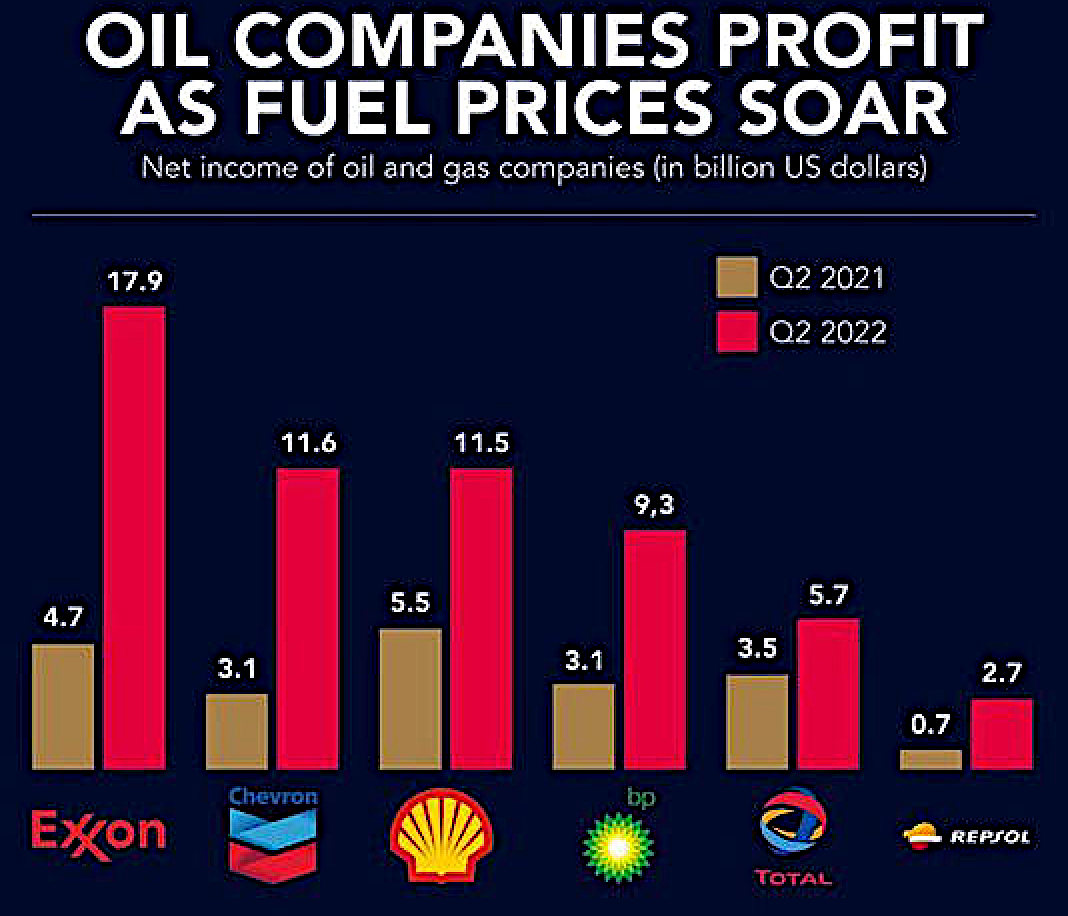

Did

the energy giants not owe the EU a duty of care, to provide alternatives

in the event of Russian aggression? Is profiteering from the misfortune

of others immoral earnings? Since, they'd not have those earnings if the

energy supply was stable. Dividends will go to shareholders, on the backs of

the poorer members of society. Another form of financial slavery perhaps.

[Demonstrably

we desperately need investment in electricity

storage infrastructure, to make the best of wasted renewable

energy that would reduce reliance on energy imports. Charge Rage, is

spelling out policy ineptitudes, such as the £2.4

trillion National Debt, burning up more of the only planet we have.

Burning equals: acid

oceans, desertification

and global

warming via climate

change. Debt is a major economic imbalance issue, perhaps warranting a moratorium

style declaration of insolvency/bankruptcy - to save Earth. Or, mucho

rapido policy changes.]

|

|

A

BIT OF RENEWABLE ENERGY HISTORY

The

first zero emission (solar powered) boat to travel around the world was the PlanetSolar,

coming home on the 4th of May 2012. PlanetSolar set off on 27th September 2010,

following the Sunshine Route, a calculated passage first showing the

maritime community the way in London at the 1994/95 Boat

Show. All efforts ignored, in favour of business as usual.

LINKS,

CONTACTS & REFERENCE

https://www.theguardian.com/business/2022/oct/21/jeremy-hunt-to-do-whatever-is-necessary-to-bring-down-national-debt

|