|

THE

WORLD'S FASTEST HYDROGEN CRUISER - In order to conquer the seven

seas with a zero pollution vessel, we have opted for a high performance trimaran hull,

ideal for experimental use of methanol and other forms of hydrogen, in the quest for zero emission waterborne

transport. Like

all technical challenges, until somebody does it, the trophy remains up for

grabs. Nobody has yet crossed the major oceans on methanol as a stored fuel.

Nobody has managed it in under 80 days. You can help us be the first. We

are the first to propose such an expedition.

One

might think that the

hardest part about building a world record contender is the design,

construction or equipping with the right technology. And yes, it is an

awesome undertaking. But in fact it is raising the funding for such an

endeavour that is the real challenge. Why would anyone contribute to

such a mission?

That

is the incredible thing, people care about our planet. And they care

sufficiently to give in many cases without asking for anything back.

Witness, the birth of crowd funding. The brilliance of which underscores

the human spirit.

THE

PITCH In

a world beset by rising temperatures, ocean pollution, and rising sea

levels, the maritime world is struggling to identify an alternative

fuel, to replace heavy oil bunker fuels. The International

Maritime Organization has responded to the harm shipping is causing

by introducing emissions lowering hard points. The first being 40% by

2030, relating to a 2008 benchmark. Seeking to divest shipping of

belching black clouds of sulfurous fumes that cause acid oceans.

DIVIDENDS:

WHAT'S IN IT FOR YOU ?

Unlike other projects, the

proposed World Hydrogen Challenge is not for

monetary gain, it is to advance the technological achievement of mankind. It is

thus a not

for profit enterprise, with noble objectives. Those objectives being the

gain - and openly (source) sharing the adventure and gathered data. It

might be asking too much from traditional crowd funding to support the

development and then operation of a vessel like the Elizabeth Swann over

a number of years where the overall cost is many times the record raised

for an ocean project. The best recent example of which is Boyan

Slat's splendid ocean cleanup boom. Like

Mr Slat, in our case the end product is not something for sale, but to be used

to demonstrate that alternative, non-polluting fuels, may allow

transport, every bit as speedily as if chugging along on fossil

fuels. An

alternative to grant funding, is equity funding. Where the project is

valued (with a suitable contingency) and then shares offered to

investors, who would like to see the diesel navigation record equaled by a

vehicle powered by hydrogen, to cover the expenses in relation to

mounting such a world record attempt. Normally,

a start up company looking to capitalize on technology they hold, or may

develop, would arrange for an Initial Public Offering (IPO). This would

be to raise substantial $millions. But before offering to the market, a

company is typically obliged to issue a prospectus; a

legal document describing securities that have been put on sale. Leaving us

out in the cold. In

recognition of the difficulties that an organisation may face in seeking funding for

a societal enterprise or a race against the clock,

there

are exemptions from the requirement to publish a prospectus, in relation to

dealings of lesser value, by, for example, not for profit concerns - as

follows: FINANCIAL

CONDUCT AUTHORITY HANDBOOK PRR 1.2 REQUIREMENT FOR A PROSPECTUS

Article 3(1) and (3) of the Prospectus Regulation provides for when a prospectus will be required:

Article 3 - Obligation to publish a prospectus and exemption

1. Without prejudice to Article 1(4), securities shall only be offered to the public in the United Kingdom after prior publication of a prospectus in accordance with this Regulation.

3. Without prejudice to Article 1(5), securities shall only be admitted to trading on a regulated market situated or operating within the United Kingdom after prior publication of a prospectus in accordance with this Regulation.

PRR 1.2.2 SECURITIES TO WHICH THE PROSPECTUS REGULATION DOES NOT APPLY

Article 1(2) and (3) of the Prospectus Regulation provides that certain transferable securities are out of scope of the Prospectus Regulation:

Article 1 - Subject matter, scope and exemptions

2. This Regulation shall not apply to the following types of securities:

(a) units issued by collective investment undertakings other than the closed-end type;

(b) non-equity securities issued by

(i) the government of any country or territory,

(ii) a local or regional authority of any country or territory,

(iii) a public international body of which any state is a member,

(iv) the European Central Bank or the central bank of any state;

(c) shares in the capital of central banks of any state;

(d) securities unconditionally and irrevocably guaranteed by the government or a local or regional authority of any country or territory;

(e) securities issued by associations with legal status or non-profit-making bodies, recognised by a state, for the purposes of obtaining the funding necessary to achieve their non-profit-making objectives;

(f) non-fungible shares of capital whose main purpose is to provide the holder with a right to occupy an apartment, or other form of immovable property or a part thereof and where the shares cannot be sold on without that right being given up.

3. Without prejudice to Article 4, this Regulation shall not apply to an offer of securities to the public with a total consideration in the United Kingdom of less than EUR 1,000,000

one million Euros, which shall be calculated over a period of 12 months.

PRR 1.2.3 EXEMPT SECURITIES - OFFERS OF SECURITIES TO THE PUBLIC

Article 1(4) of the Prospectus Regulation provides that certain offers of transferable securities to the public are exempt from the obligation to publish a prospectus:

Article 1 - Subject matter, scope and exemptions

4. The obligation to publish a prospectus set out in Article 3(1) shall not apply to any of the following types of offers of securities to the public:

(a) an offer of securities addressed solely to qualified investors;

(b) an offer of securities addressed to fewer than 150 natural or legal persons in the United Kingdom, other than qualified investors;

(c) an offer of securities whose denomination per unit amounts to at least EUR 100 000;

(d) an offer of securities addressed to investors who acquire securities for a total consideration of at least EUR 100 000 per investor, for each separate offer;

(e) shares issued in substitution for shares of the same class already issued, if the issuing of such new shares does not involve any increase in the issued capital;

(f) subject to paragraph 6a, securities offered in connection with a takeover by means of an exchange offer, provided that a document is made available to the public in accordance with the arrangements set out in Article 21(2), containing information describing the transaction and its impact on the issuer;

(g) subject to paragraph 6b, securities offered, allotted or to be allotted in connection with a merger or division, provided that a document is made available to the public in accordance with the arrangements set out in Article 21(2), containing information describing the transaction and its impact on the issuer;

(h) dividends paid out to existing shareholders in the form of shares of the same class as the shares in respect of which such dividends are paid, provided that a document is made available containing information on the number and nature of the shares and the reasons for and details of the offer;

(i) securities offered, allotted or to be allotted to existing or former directors or employees by their employer or by an affiliated undertaking provided that a document is made available containing information on the number and nature of the securities and the reasons for and details of the offer or allotment;

(j) non-equity securities issued in a continuous or repeated manner by a credit institution, where the total aggregated consideration in the United Kingdom for the securities offered is less than EUR 75 000 000 per credit institution calculated over a period of 12 months, provided that those securities:

(i) are not subordinated, convertible or exchangeable; and

(ii) do not give a right to subscribe for or acquire other types of securities and are not linked to a derivative instrument.

PRR 1.2.4 EXEMPT SECURITIES - ADMISSION TO TRADING ON A REGULATED MARKET

Article 1(4) of the Prospectus Regulation provides that certain offers of transferable securities to the public are exempt from the obligation to publish a prospectus:

Article 1 - Subject matter, scope and exemptions

4. The obligation to publish a prospectus set out in Article 3(1) shall not apply to any of the following types of offers of securities to the public:

(a) an offer of securities addressed solely to qualified investors;

(b) an offer of securities addressed to fewer than 150 natural or legal persons in the United Kingdom, other than qualified investors;

(c) an offer of securities whose denomination per unit amounts to at least EUR 100 000;

(d) an offer of securities addressed to investors who acquire securities for a total consideration of at least EUR 100 000 per investor, for each separate offer;

(e) shares issued in substitution for shares of the same class already issued, if the issuing of such new shares does not involve any increase in the issued capital;

(f) subject to paragraph 6a, securities offered in connection with a takeover by means of an exchange offer, provided that a document is made available to the public in accordance with the arrangements set out in Article 21(2), containing information describing the transaction and its impact on the issuer;

(g) subject to paragraph 6b, securities offered, allotted or to be allotted in connection with a merger or division, provided that a document is made available to the public in accordance with the arrangements set out in Article 21(2), containing information describing the transaction and its impact on the issuer;

(h) dividends paid out to existing shareholders in the form of shares of the same class as the shares in respect of which such dividends are paid, provided that a document is made available containing information on the number and nature of the shares and the reasons for and details of the offer;

(i) securities offered, allotted or to be allotted to existing or former directors or employees by their employer or by an affiliated undertaking provided that a document is made available containing information on the number and nature of the securities and the reasons for and details of the offer or allotment;

(j) non-equity securities issued in a continuous or repeated manner by a credit institution, where the total aggregated consideration in the United Kingdom for the securities offered is less than EUR 75 000 000 per credit institution calculated over a period of 12 months, provided that those securities:

(i) are not subordinated, convertible or exchangeable; and

(ii) do not give a right to subscribe for or acquire other types of securities and are not linked to a derivative instrument.

PR 1.2.5 ARTICLE (6), (6A) AND (6B) PROVIDE AS FOLLOWS IN RELATION TO EXEMPTIONS:

Article 1 - Subject matter, scope and exemptions

6. The exemptions from the obligation to publish a prospectus that are set out in paragraphs 4 and 5 may be combined together. However, the exemptions in points (a) and (b) of the first subparagraph of paragraph 5 shall not be combined together if such combination could lead to the immediate or deferred admission to trading on a regulated market over a period of 12 months of more than 20% of the number of shares of the same class already admitted to trading on the same regulated market, without a prospectus being published.

6a. The exemptions set out in point (f) of paragraph 4 and in point (e) of paragraph 5 shall only apply to equity securities, and only in the following cases: (a) the equity securities offered are fungible with existing securities already admitted to trading on a regulated market prior to the takeover and its related transaction, and the takeover is not considered to be a reverse acquisition transaction within the meaning of paragraph B19 of international financial reporting standard (IFRS) 3, Business Combinations, adopted by Commission Regulation (EC) No 1126/2008; or (b) the FCA has issued a prior approval, under paragraph 6c of this Article, for the documents referred to in point (f) of paragraph 4 or point (e) of paragraph 5 of this Article.

6b. The exemptions set out in point (g) of paragraph 4 and in point (f) of paragraph 5 shall apply only to equity securities in respect of which the transaction is not considered to be a reverse acquisition transaction within the meaning of paragraph B19 of IFRS 3, Business Combinations, and only in the following cases: (a) the equity securities of the acquiring entity have already been admitted to trading on a regulated market prior to the transaction; or (b) the equity securities of the entities subject to the division have already been admitted to trading on a regulated market prior to the transaction. 6c. The FCA may issue prior approval for the documents referred to in point (f) of paragraph 4 or point

(e) of paragraph 5 of this Article.

PRR 1.2.6 VOLUNTARY PROSPECTUS

Article 1 - Subject matter, scope and exemptions

6. The exemptions from the obligation to publish a prospectus that are set out in paragraphs 4 and 5 may be combined together. However, the exemptions in points (a) and (b) of the first subparagraph of paragraph 5 shall not be combined together if such combination could lead to the immediate or deferred admission to trading on a regulated market over a period of 12 months of more than 20% of the number of shares of the same class already admitted to trading on the same regulated market, without a prospectus being published.

6a. The exemptions set out in point (f) of paragraph 4 and in point (e) of paragraph 5 shall only apply to equity securities, and only in the following cases: (a) the equity securities offered are fungible with existing securities already admitted to trading on a regulated market prior to the takeover and its related transaction, and the takeover is not considered to be a reverse acquisition transaction within the meaning of paragraph B19 of international financial reporting standard (IFRS) 3, Business Combinations, adopted by Commission Regulation (EC) No 1126/2008; or (b) the FCA has issued a prior approval, under paragraph 6c of this Article, for the documents referred to in point (f) of paragraph 4 or point (e) of paragraph 5 of this Article. 6b. The exemptions set out in point (g) of paragraph 4 and in point (f) of paragraph 5 shall apply only to equity securities in respect of which the transaction is not considered to be a reverse acquisition transaction within the meaning of paragraph B19 of IFRS 3, Business Combinations, and only in the following cases: (a) the equity securities of the acquiring entity have already been admitted to trading on a regulated market prior to the transaction; or (b) the equity securities of the entities subject to the division have already been admitted to trading on a regulated market prior to the transaction. 6c. The FCA may issue prior approval for the documents referred to in point (f) of paragraph 4 or point (e) of paragraph 5 of this Article.

PRR 1.2.7 PROSPECTUS FOR RESALE OF TRANSFERABLE SECURITIES

Article 5 of the Prospectus Regulation provides for when an additional prospectus is, and is not, required in case of a subsequent resale of transferable securities:

Article 5 - Subsequent resale of securities

1. Any subsequent resale of securities which were previously the subject of one or more of the types of offer of securities to the public listed in points (a) to (d) of Article 1(4) shall be considered as a separate offer and the definition set out in point (d) of Article 2 shall apply for the purpose of determining whether that resale is an offer of securities to the public. The placement of securities through financial intermediaries shall be subject to publication of a prospectus unless one of the exemptions listed in points (a) to (d) of Article 1(4) applies in relation to the final placement. No additional prospectus shall be required in any such subsequent resale of securities or final placement of securities through financial intermediaries as long as a valid prospectus is available in accordance with Article 12 and the issuer or the person responsible for drawing up such prospectus consents to its use by means of a written agreement.

2. Where a prospectus relates to the admission to trading on a regulated market of non-equity securities that are to be traded only on a regulated market, or a specific segment thereof, to which only qualified investors can have access for the purposes of trading in such securities, the securities shall not be resold to non-qualified investors, unless a prospectus is drawn up in accordance with this Regulation that is appropriate for non-qualified investors. NOT

A THINK TANK, A DO TANK The

Elizabeth Swann design and features, forms part of a portfolio of

Intellectual Property, that investors can buy into and share in the

adventure, helping to accelerate the transition to zero emission

shipping, in the process, showing the world what is possible.

Not

by

speaking about it, but by doing it.

NOTE:

This

is not a prospectus.

LINKS

& REFERENCE https://www.handbook.fca.org.uk/handbook/PRR/1/2.html

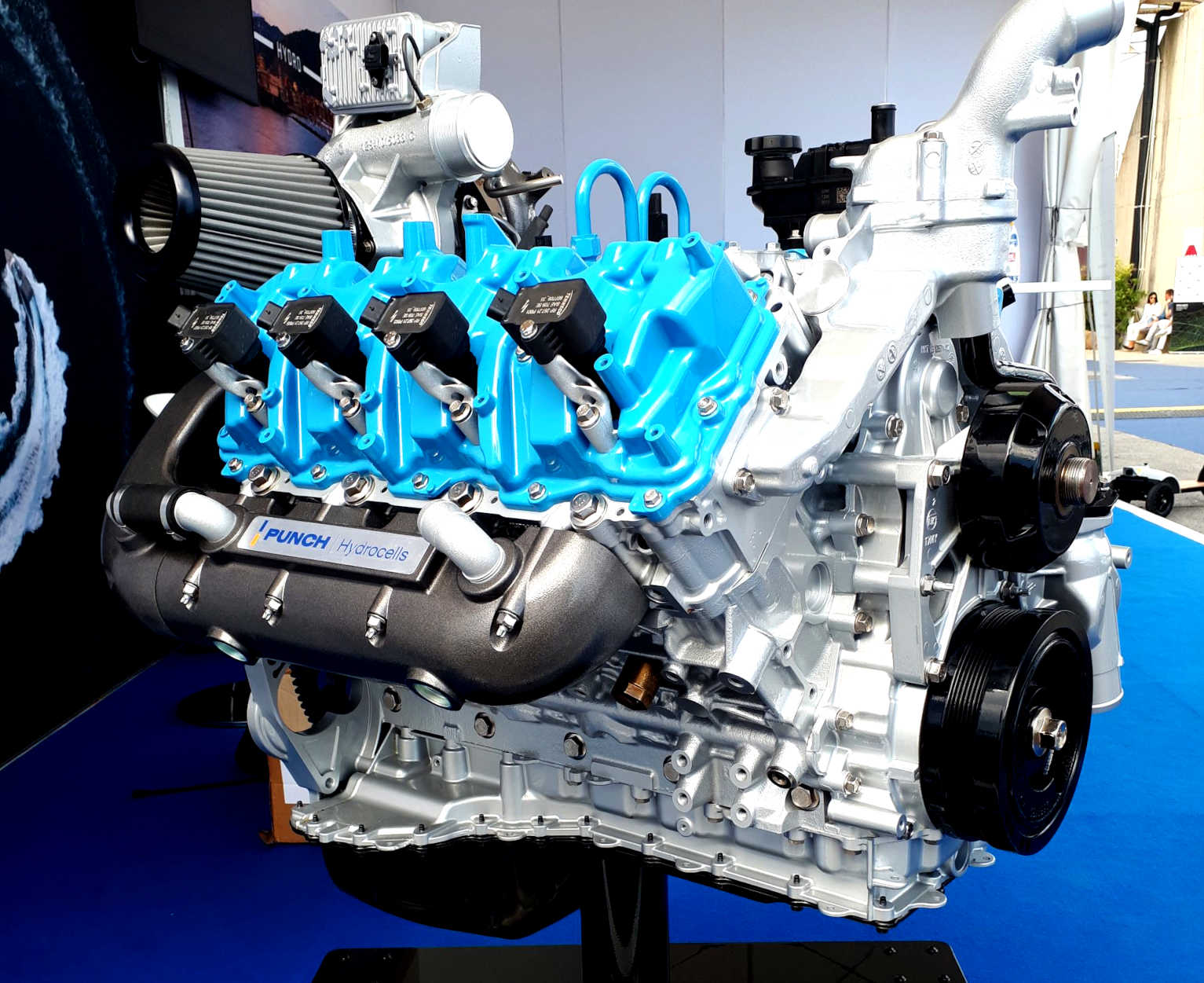

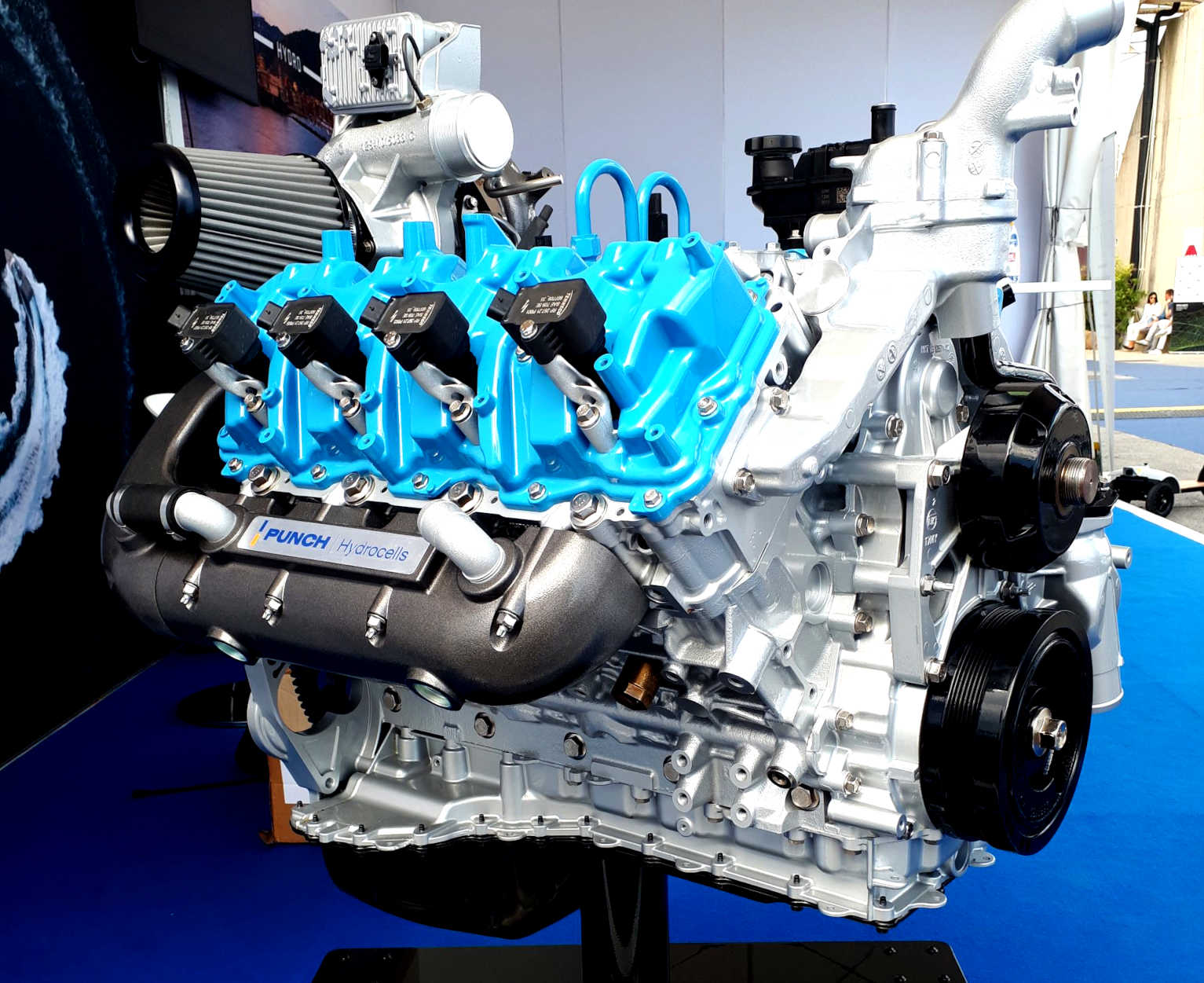

DURAMAX

- Hydrogen fueled diesel engines such as the 6.6 liter unit above, retain

the familiar ICE format and service life limitations with the advantage that ship

operators understand the technology. The, "better the devil we

know" approach, is better than no advance at all.

...

|